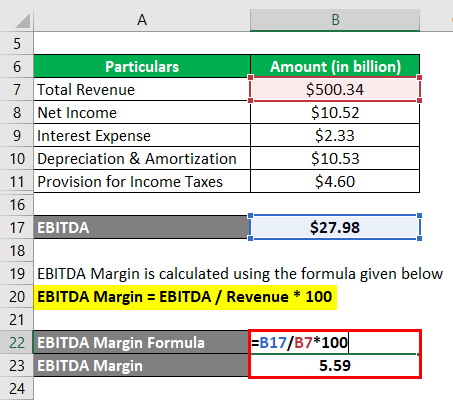

Ebitda margin calculation

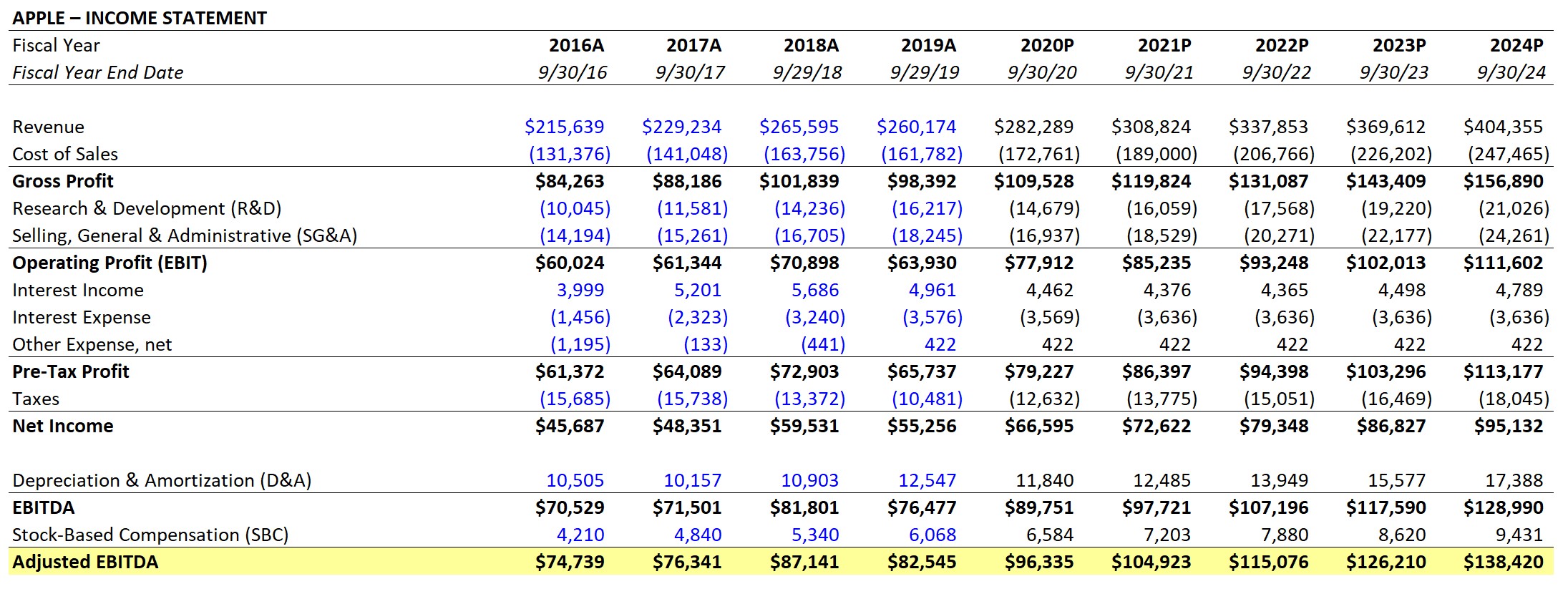

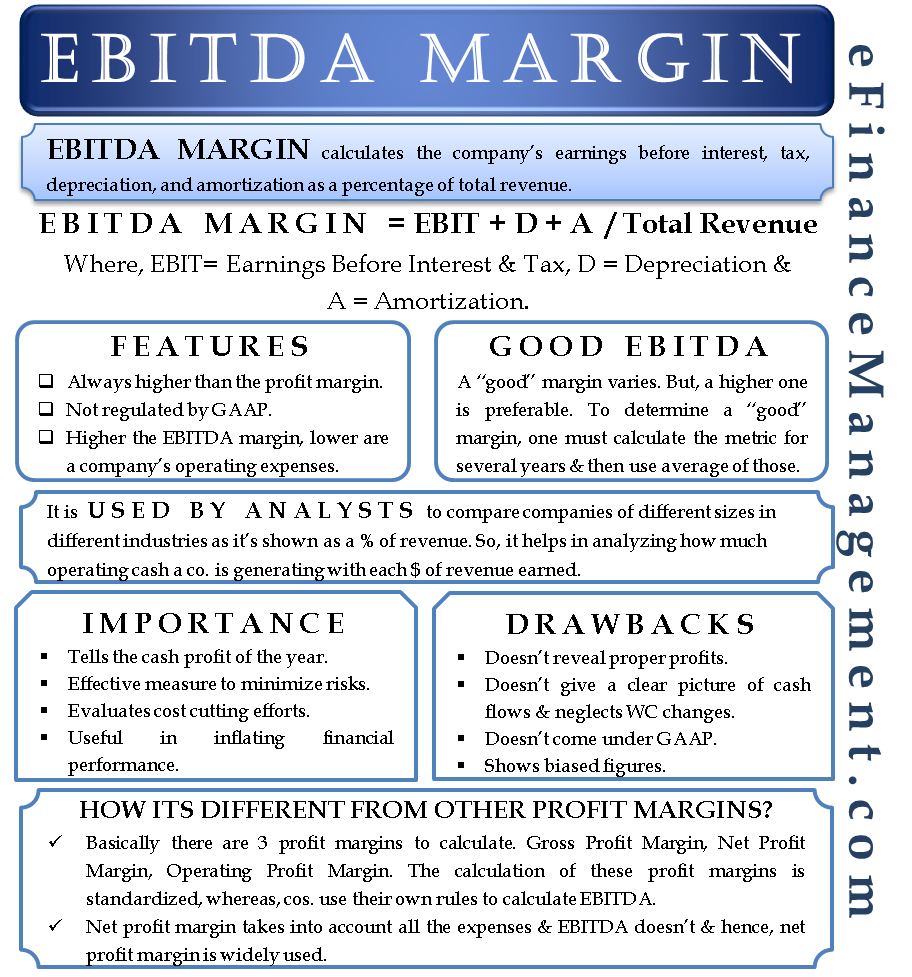

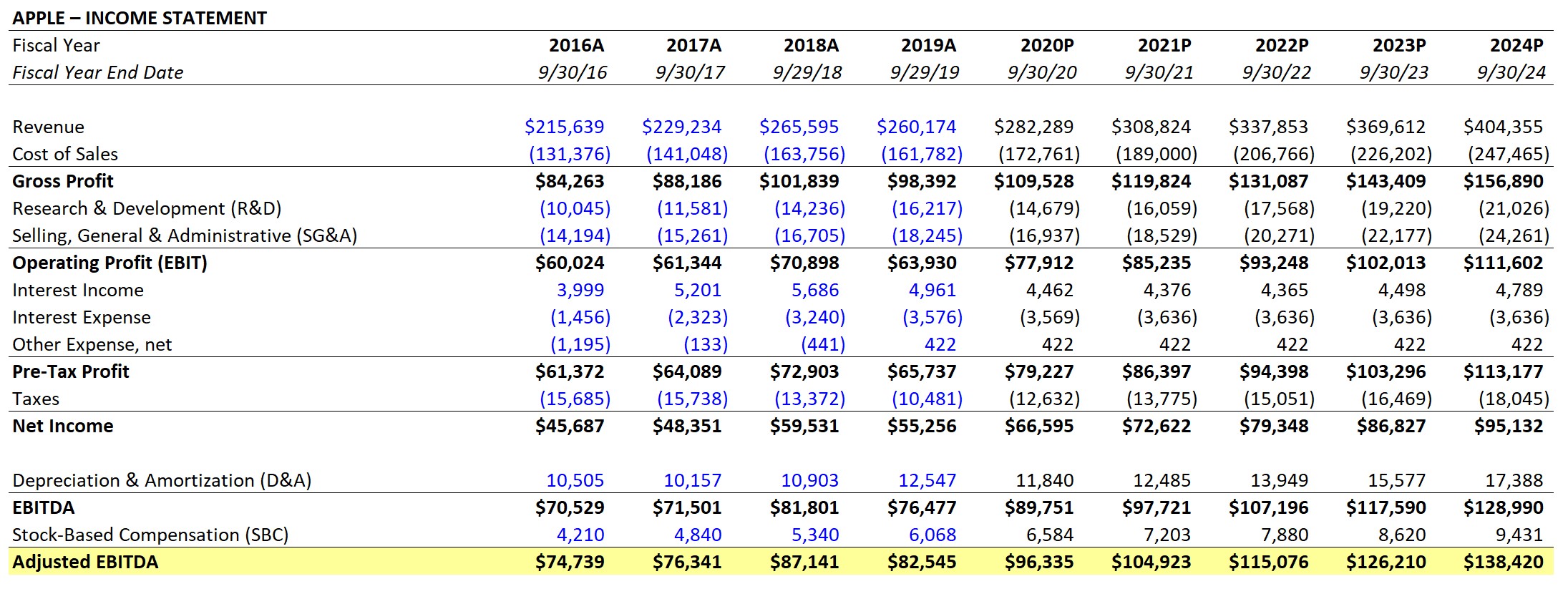

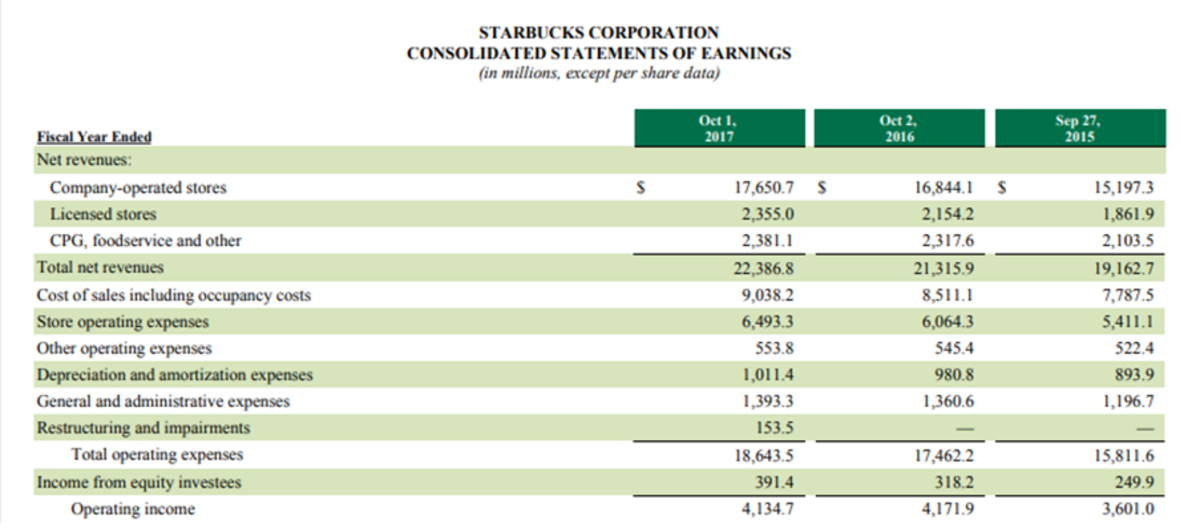

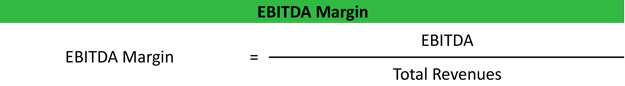

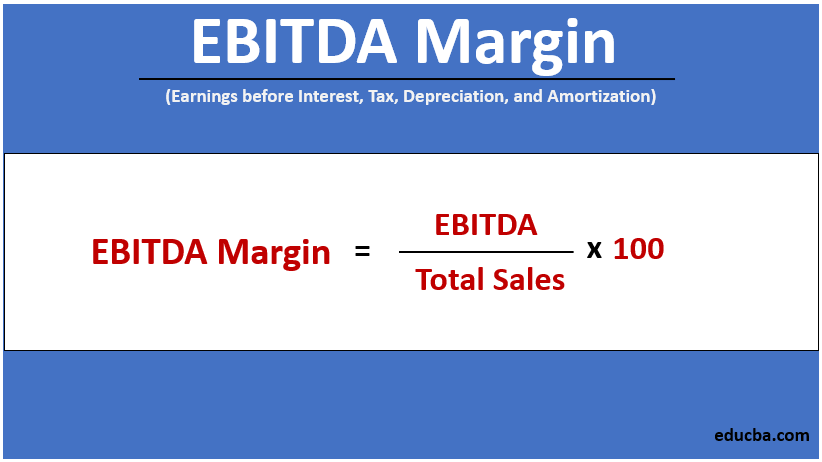

Divide by total revenue. One of the most commonly used metrics in analyzing the financials of a company is the EBITDA or the Earnings before Interest Taxes Depreciation.

Ebitda Margin Formula And Calculator Excel Template

Enter a companys net earnings interest expenses.

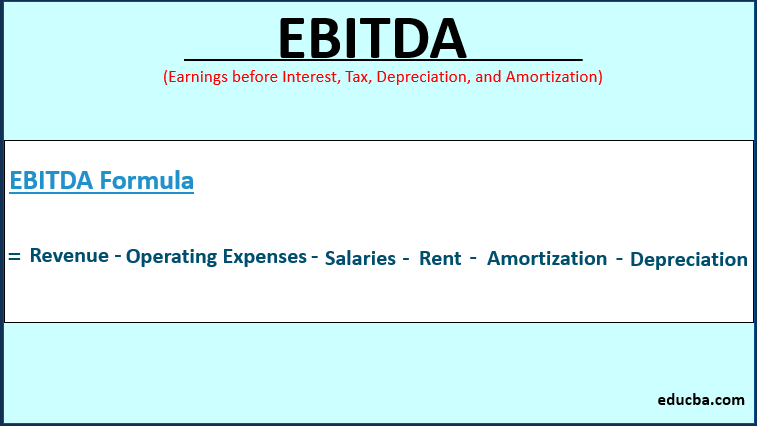

. For example an average EBITDAsales margin for the advertising. The second formula for calculating EBITDA is. The formula for measuring EBITDA is.

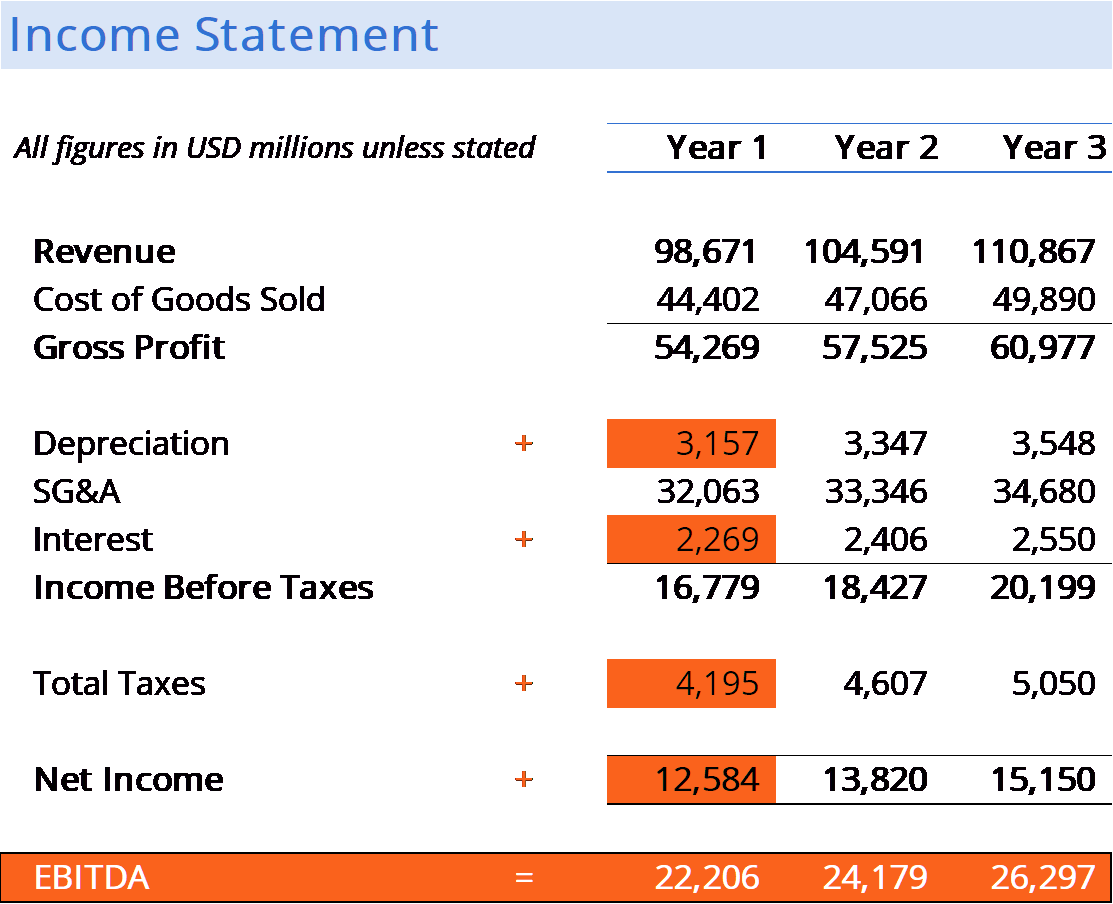

Consider EBITDA as a measure of a companys ability to be profitable in the absence of. EBITDA margin earnings before interest and tax depreciation amortization total revenue That makes it easy to compare the relative profitability of two or. EBITDA Net income interest expenses tax depreciation amortization Suppose a companys revenues are Rs.

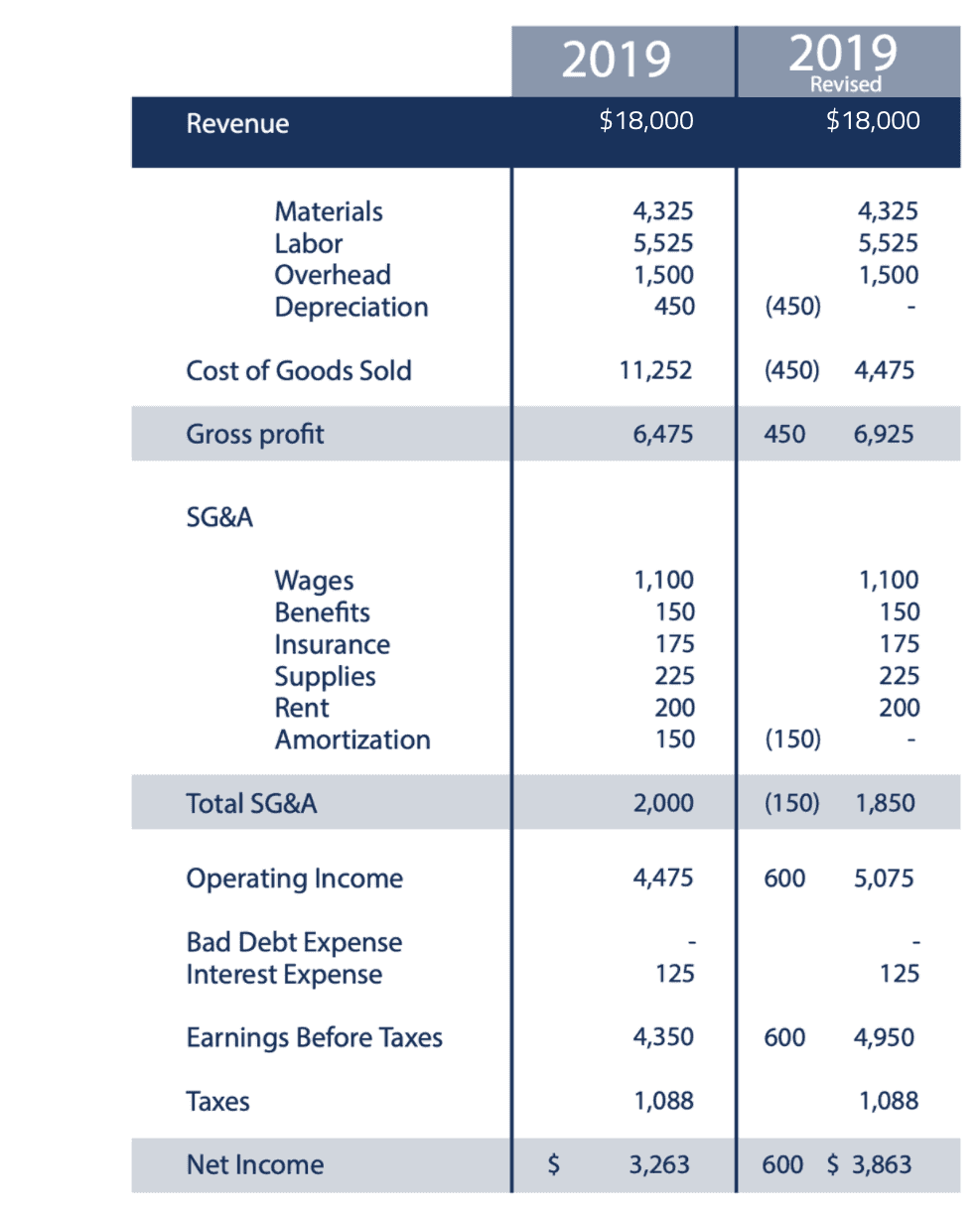

EBITDA margin is a measure of a companys profitability calculated as EBITDA earnings before interest taxes depreciation and amortization divided by total revenue. Unlike the first formula. You can format your EBITDA as a percentage to make it easier to compare to the margins of your competitors.

To find your EBITDA margin. Applying the formula is as follows. There are two formulas that can be used for your business EBITDA calculation.

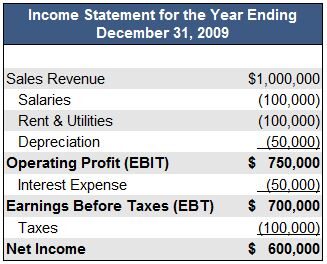

EBITDA Operating profit Amortization Depreciation Here the operating profit refers to the profits made before interest and taxes have been deducted. Below is an EBITDA margin calculator to compute earnings before interest expenses taxes depreciation and amortization margin. Using Net Income.

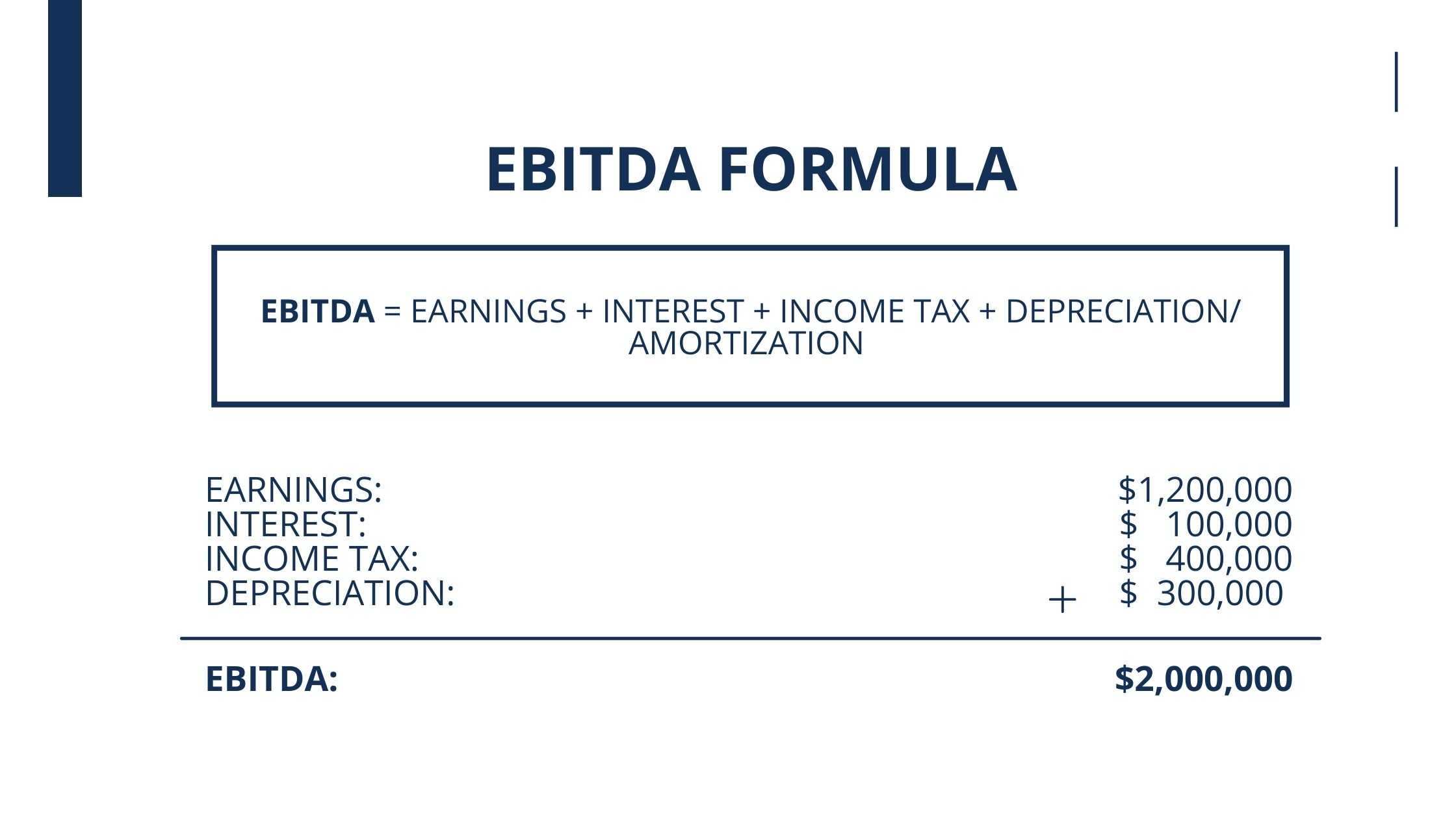

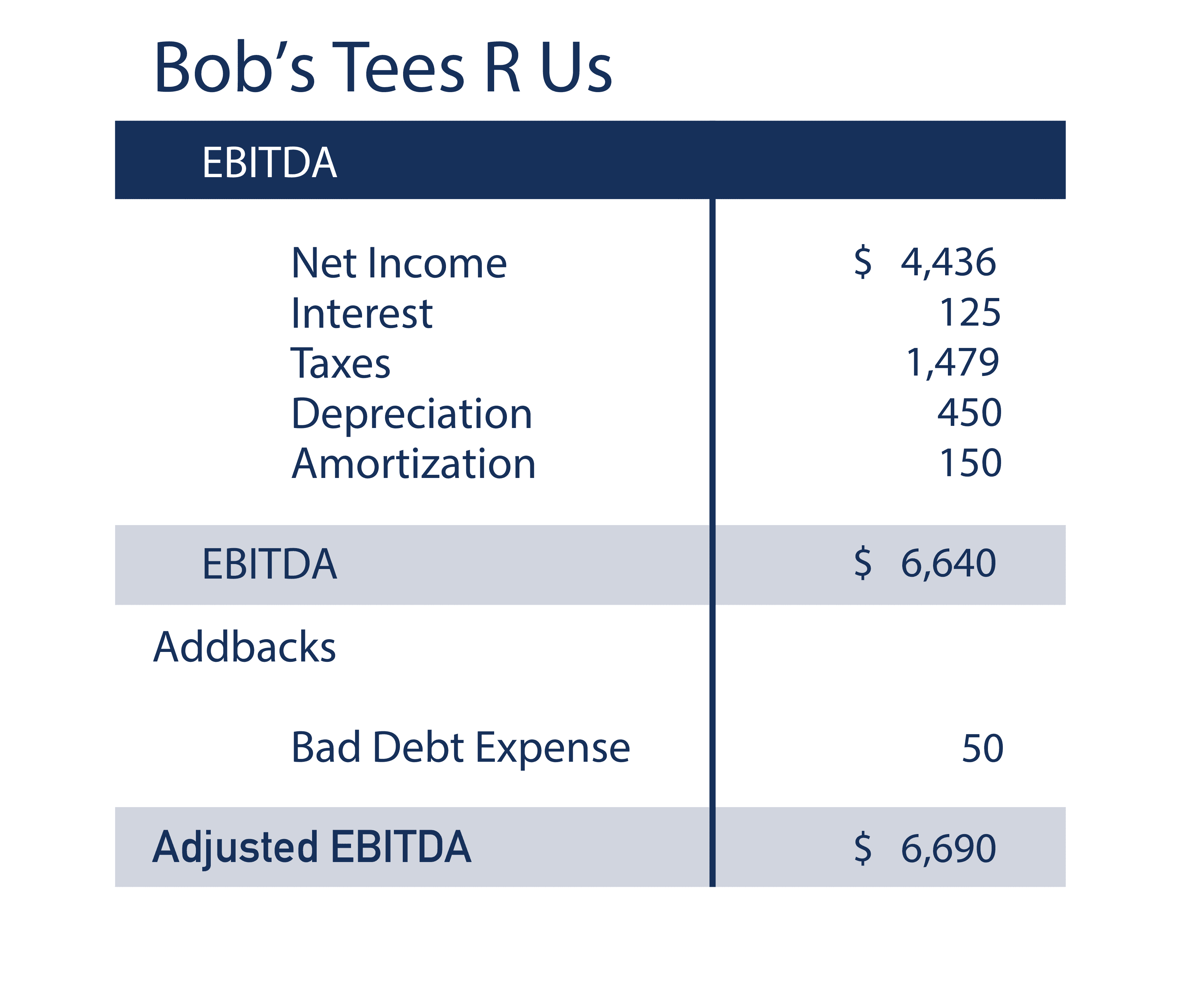

EBITDA Net Income Interest Taxes Depreciation Amortization Expenses EBITDA 150000 9000 17000 4000 6000 EBITDA 186000 Now using EBITDA. To know if an EBITDA multiple is good you must look at it compared to other similar types of businesses. Formula 1 EBITDA Net Income Interest Taxes Depreciation Amortization Calculation begins at.

EBITDA Net Income Taxes Interest Expense Depreciation Amortization. You can calculate EBITDA margin of both companies as follows. EBITDA margin 1800000 200000 10000000 20.

You can calculate your EBITDA easily by looking at your financial statements. EBITDA margin is a profitability ratio to measure how much a company profits from recorded revenue after adjusting for non-cash items but before paying interest and. How to Calculate EBITDA Margin In the final part the EBITDA margins for each company can be calculated by dividing the calculated EBITDA by revenue.

What Is Ebitda Formula Example Margin Calculation Explanation

Ebitda Margin Definition Example Investinganswers

Full Ebitda Guide What Is It How Investors Use It Formula

Ebitda Margin Features Importance Drawbacks Other Profit Margins

How To Calculate Ebitda Margin

Ebitda Margin Definition Advantages And Limitations Of Ebitda Margin

Ebitda Margin Formula And Calculator Excel Template

Ebitda Margin Formula Definition And Explanation

Ebitda Types And Components Examples And Advantages Of Ebitda

What Is An Ebitda Margin Examples And How To Calculate Thestreet

Ebitda Margins What Every Small Company Owner Needs To Know

How Do I Calculate An Ebitda Margin Using Excel

What Is Ebitda Formula Definition And Explanation

What Is Ebitda Formula Example Margin Calculation Explanation

Ebitda Margin Definition Advantages And Limitations Of Ebitda Margin

Ebitda Margin Formula Meaning Interpretation With Examples

Full Ebitda Guide What Is It How Investors Use It Formula